10 most popular money transfer systems from Poland: choose the most convenient option

Many foreigners living or working in Poland often transfer money to their home countries. Thanks to modern technology, it’s easier than ever to do so quickly, conveniently, and at a favorable rate. In this article, we’ll take a look at the 10 most popular money transfer systems from Poland to other countries.

1. Wise (formerly TransferWise)

Wise allows you to transfer funds at a favorable exchange rate with minimal fees. The service is transparent – you always know how much the recipient will receive.

- Advantages: Favorable exchange rate, low fees, convenient mobile application.

- Disadvantages: Delivery time may vary depending on the payment method.

2. Western Union.

This is one of the oldest and most reliable systems. Western Union has thousands of branches in Poland and worldwide, as well as the possibility of online transfers.

- Advantages: Wide network, instant transfers.

- Disadvantages: High fees, especially for large amounts.

3. PayPal.

Although PayPal is commonly used for online payments, it is also suitable for international money transfers.

- Advantages: Ease of use, security.

- Disadvantages: Restrictions on the availability of funds in some countries.

4. Revolut

Revolut is not only a mobile bank, but also a convenient way to transfer funds abroad. It offers favorable conditions for international transactions.

- Advantages: High level of security, speed of transfers.

- Disadvantages: The need to create an account.

5. MoneyGram.

Similar to Western Union, this service allows you to send money both online and through physical branches.

- Advantages: Network in many countries, fast transfers.

- Disadvantages: High fees.

6. Paysend.

The service specializes in international transfers and allows you to send money directly to the recipient’s bank card.

- Advantages: Fixed fee, simple interface.

- Disadvantages: Some banks may charge additional fees.

7. TransferGo.

This service offers low rates and the ability to transfer money even on the same day.

- Advantages: Speed, favorable rate.

- Disadvantages: Availability depends on the recipient’s country.

8. Ria Money Transfer

Ria is a popular service with a wide network of service points. Online transfers are also available.

- Advantages: Availability in many countries, various ways to receive.

- Disadvantages: High fees for large amounts.

9. Azimo.

Azimo offers favorable conditions for transfers, especially for new users.

- Advantages: First transaction is free, favorable rate.

- Disadvantages: Instant transfers are not always available.

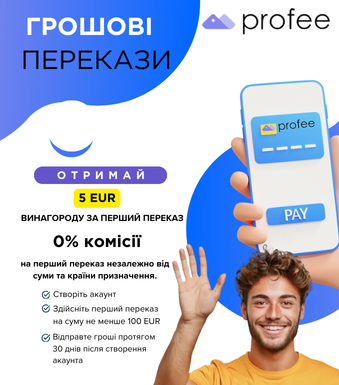

10. Profee

Profee is a modern international money transfer system that allows you to send money from Poland to other countries quickly and securely. This platform is aimed at users looking for a convenient way to send money directly to bank cards.

- Advantages:

- Instant transfers (funds usually arrive within a few minutes).

- No hidden fees – users know the exact amount of the transfer and receipt.

- Intuitive interface for the mobile app and web platform.

- Ability to send money directly to Visa or Mastercard bank cards.

- Disadvantages:

- The limit on the maximum transfer amount depends on the selected country and region.

- Support is still limited to certain banks.

Profee is ideal for those looking for quick and easy transfers with minimal time and money.

11. Transfer through banks

Banks in Poland offer standard SWIFT transfers. This is a reliable but often more expensive way.

- Advantages: High reliability.

- Disadvantages: High fees and long processing times.

How to choose the best service?

When choosing a money transfer system, consider the following:

- Commission and exchange rate: Choose services with minimal currency conversion losses.

- Transfer speed: Important if you need funds urgently.

- Convenience: Availability of a mobile application or physical branches in your region.

- Security: Choose trusted services that guarantee the protection of your funds.

Each of these services has its advantages and disadvantages. Choose the one that best suits your needs, taking into account fees, convenience, and transfer speed.