Azimo: Everything you need to know about this money transfer system

Azimo is a popular international money transfer platform that has gained the trust of millions of users around the world. It provides a convenient, fast and affordable way to transfer money from one country to another, including transfers from Poland to your home country. In this article, we will take a closer look at the advantages, disadvantages, features of Azimo and its main functions.

What is Azimo?

Azimo is a fintech company that specializes in international money transfers. Founded in 2012, it aims to make financial services more accessible and transparent. The platform allows you to transfer money to more than 80 countries, covering more than 200 currencies.

How does Azimo work?

Azimo operates through a mobile app and a website. You can transfer money in a few simple steps:

- Registration: Create an account through the app or website.

- Data entry: Selecting the recipient’s country, entering the amount and the recipient’s data (bank account, card number, or cash point).

- Payment: You can pay for the transfer from your bank account, card, or other available methods.

- Tracking: Azimo provides the ability to track the status of the transfer in real time.

Advantages of Azimo

- Favorable rates

- Azimo offers low fees compared to traditional banks. Often, the first transfer is free.

- Speed.

- Most transfers are completed within 24 hours, and sometimes funds are received instantly.

- Convenience

- The mobile app and website are easy to use, making the platform accessible even for beginners.

- Various methods of receipt

- Users can receive money through:

- Bank accounts.

- Visa and Mastercard cards.

- Cash withdrawal points.

- Transparency.

- Azimo shows the exact exchange rate, the amount of commission, and the amount the recipient will receive even before the transfer is confirmed.

- Availability in Poland

- Azimo is popular among foreigners in Poland due to its convenience and support for many transfer currencies.

Azimo disadvantages

- Transfer limits

- The maximum transfer amount depends on the country and payment method, which can be inconvenient for large transactions.

- Dependence on the Internet

- Azimo works only via the Internet, so you need a stable connection to access the platform.

- Additional costs in some cases

- Although Azimo’s fees are low, recipient banks may charge additional fees.

How do I transfer money via Azimo from Poland to my country?

- Download the Azimo app or go to the website.

- Register or log in to your account.

- Select your country as the recipient country.

- Enter the amount you want to transfer.

- Select the method of receipt (bank account, card, or cash withdrawal).

- Pay for the transfer using your bank card or account.

- Send the transfer and receive a confirmation.

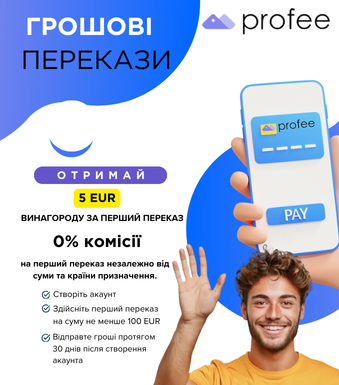

Azimo service fees

Azimo offers a transparent tariff policy:

- The fee depends on the amount of the transfer and the method of receipt.

- The exchange rate is more favorable than in many banks or systems.

- The first transaction is free for new users.

Security and reliability

Azimo adheres to high security standards. The platform is licensed and regulated by EU financial authorities, which guarantees the protection of users’ funds.

User feedback

Most Azimo users praise the service for its convenience, speed, and low fees. However, there is also criticism about transfer limits and additional fees from recipient banks.

Why choose Azimo?

Azimo is an ideal choice for those looking for a simple, affordable, and fast way to transfer funds. It is suitable for both large transactions and regular transfers of small amounts.

Azimo is one of the leaders in the international money transfer market, providing convenience, accessibility, and transparency. If you are based in Poland and want to transfer money to your home country, Azimo is a great option due to its low fees and convenient conditions.