PIT declaration: How to fill out and submit an income tax return in Poland

The annual filing of a PIT (Podatek dochodowy od osób fizycznych) tax return is an obligation of every taxpayer in Poland who receives income. The PIT declaration includes all sources of income and provides an opportunity to take advantage of tax rebates. In this article, we will look at the main types of PIT declarations, the steps to complete them, the possibilities for deductions and benefits, and how to file the declaration online.

1. Main types of PIT declarations in Poland

There are several forms of PIT declarations in Poland, depending on the type of income of the taxpayer:

- PIT-37 – for employees who receive income under an employment contract or a contractor agreement and do not have additional entrepreneurial income.

- PIT-36 – for individuals engaged in entrepreneurial activities, as well as for those who have income from various sources, including foreign income.

- PIT-28 – for taxpayers who use the reduced tax (ryczałt) for business activities or rent out real estate.

- PIT-38 – for persons with income from securities or other investments.

- PIT-39 – for those who receive income from the sale of real estate.

For most employees who receive income solely from employment, the PIT-37 form is suitable. Entrepreneurs and people with combined income may need PIT-36 or PIT-28.

2. Deadline for filing a PIT declaration

Each type of declaration has its own deadlines:

- PIT-37 and PIT-36 – by April 30 of the year following the reporting year.

- PIT-28 – by February 28 of the year following the reporting year.

- PIT-38 and PIT-39 are also due by April 30.

Late filing may result in penalties, so it is important to meet the deadlines.

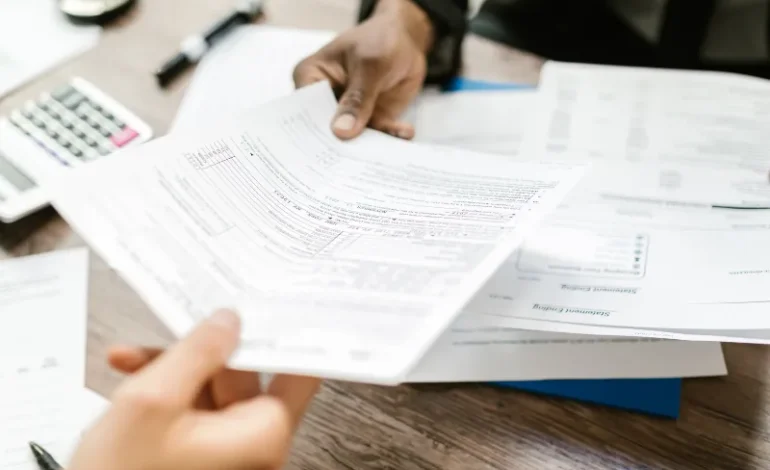

3. Preparing to complete the PIT return

Before filling out the declaration, it is important to collect all the necessary documents confirming income and tax deductions for the reporting year. These documents include:

- PIT-11 certificate – provided by the employer or customer and containing information on the income received and tax withheld.

- Documents on additional income (for example, from rent, investments, etc.).

- Certificates of benefits and discounts (for medical treatment, children’s education, charity, internet).

Collecting the necessary documents is an important step, as it will allow you to correctly reflect your income, reduce your tax base due to benefits and avoid mistakes.

4. How to fill out the PIT declaration correctly

To fill out a PIT return correctly, you need to follow the following steps:

Step 1: Selecting the declaration form

Choose the PIT form that corresponds to your sources of income. For example, for salary – PIT-37, and for entrepreneurial activity – PIT-36.

Step 2: Entering personal data

At the beginning of the declaration, you need to provide your personal data – name, PESEL or NIP number, address of residence and tax office.

Step 3: Entering income data

Enter the income received during the year according to PIT-11 certificates or other supporting documents. There is a separate line for each type of income.

Step 4: Deductions and discounts

After entering your income, indicate all deductions and tax rebates that you are entitled to. There are a number of discounts in Poland, for example:

- For children (ulga na dzieci ) – a benefit for raising children, which allows you to significantly reduce your tax liability.

- For the Internet (ulga na internet) – a benefit for those who use the Internet.

- For medical expenses and medicines.

- Discount on charitable contributions.

Step 5: Calculating the final tax amount

After filling in the data on income and deductions, the system will automatically calculate the total amount of tax to be paid or a refund if you have overpaid.

5. How to file a PIT return

There are several ways to file a PIT return:

- Online (e-Deklaracje): The most convenient way to file online is through the e-Urząd Skarbowy portal or the Twój e-PIT app. This method saves time and allows you to track the status of the declaration.

- In person at the tax office: You can submit a paper form directly to a tax office.

- By mail: Sending a paper form by registered mail to the tax office.

Online filing is the most popular as it is simple, secure and convenient, especially for those who have an electronic signature or access to a trusted profile (Profil Zaufany).

6. How to use the automatic filling of the declaration via Twój e-PIT

The Twój e-PIT service is an automated system that fills in the tax return based on data received from employers and other sources. The taxpayer just needs to log in, check the accuracy of the data and, if necessary, make changes or add benefits.

Main advantages of Twój e-PIT:

- Automatic filling: all the basic data is already entered.

- Editable: you can add discounts and benefits or change sources of income.

- Quick submission: you can submit your tax return in a few clicks without the need for additional documents.

Twój e-PIT greatly simplifies the reporting process for most citizens and reduces the risk of errors.

7. What to do after submitting the declaration

After submitting your tax return, it is important to keep proof that the report was received by the tax office. If you filed your tax return online, you will receive an electronic confirmation (UPO), a document that confirms the successful submission.

If the tax calculation shows that you have an overpayment, the tax office will refund the money to the bank account you specified. The tax refund usually takes place within 45 days for electronic tax returns and up to 3 months for paper returns.

8. Common mistakes when filling out a PIT return and how to avoid them

To avoid mistakes when filing a declaration, follow these recommendations:

- Choose the right form of declaration according to the sources of income.

- Check all the data – personal information, PESEL or NIP number, amounts of income and expenses.

- Don’t forget about deductions – take advantage of all available discounts.

- Submit the declaration on time – late submission may result in penalties.

Important summary of the above

Filing a PIT declaration in Poland is a mandatory procedure for individuals who receive income. It is important to prepare the documents in time, fill out the form correctly, take advantage of the available benefits, and submit the declaration through a channel convenient for you. Using the Twój e-PIT online service or the e-Deklaracje portal greatly simplifies the filing process and reduces the risk of errors.